STE. GENEVIEVE – Tax consequences of the previous year are not often thought about until the bill comes due the next year – when nothing can be done. Farm operations need to be thinking ahead of the new year says Rachel Hopkins, Ag Business Specialist. Depending on payment amounts received, what livestock sales took place, drought declarations and other circumstances, producers could find themselves in situation where they have a substantial tax liability for 2023.

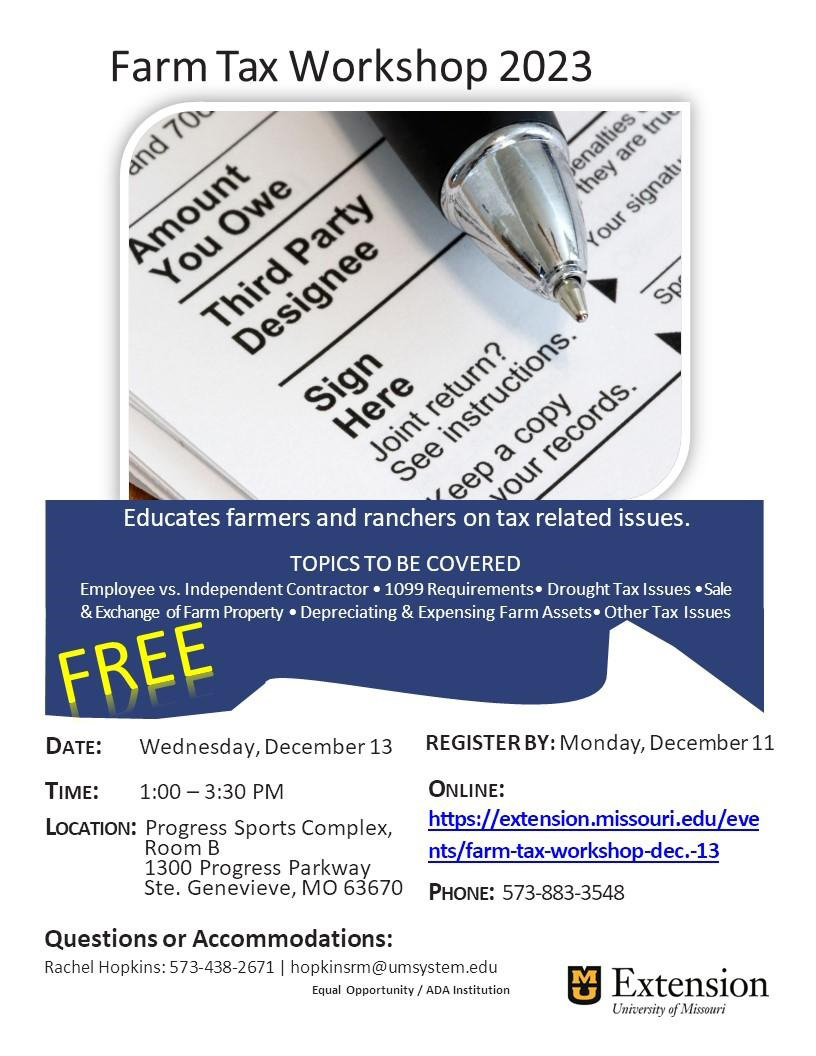

There are options for producers to navigate through tax implications and reduce the taxable burden as much as possible. The topics covered can help producers during the Farm Tax Workshop on Wednesday, December 13 in Ste. Genevieve, the different options are discussed so producers can have a better grasp on what each option involves.

Topics covered are: Employee vs. Independent Contractor, Sunset of Increased Estate and Gift Tax Exemption, Expiration of Key Income Tax Provisions, Form 1099 Requirements, Livestock Tax Issues – Drought Sales, Tax Issues Arising from the Death of a Farmer, Depreciating and Expensing Farm Assets and Sale and Exchange of Farm Property.

Farm Tax Workshop will take place at the Progress Sports Complex, Room B, 1300 Progress Parkway, Ste. Genevieve, MO and will run from 1:00 – 3:30 PM. Register online at https://extension.missouri.edu/events/farm-tax-workshop-dec.-13 .

Currently attendees can call the Ste. Genevieve County Extension office at 573-883-3548 to register via phone.

There is no cost to attend, but registration is required. If interested attendees have questions, contact Rachel Hopkins at 573-438-2671 or hopkinsrm@umsystem.edu.