SPRINGFIELD — State Senators Erica Harriss (56th District), Jil Tracy (50th District) and Chapin Rose (51st District) addressed Capitol media Thursday, Feb. 27.

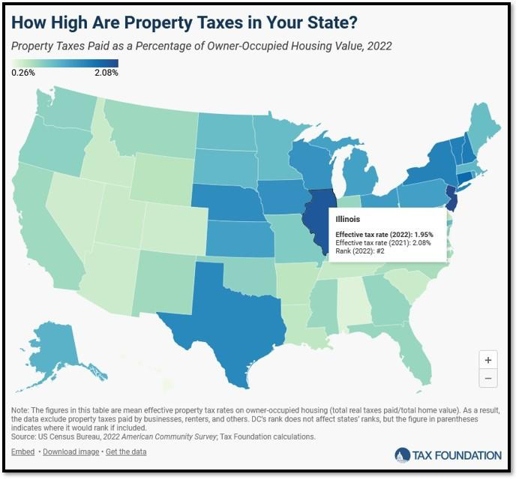

They said Illinois has the second highest property tax rate among the 50 states, with an average of about two percent of home value paid each year. That is double the national rate.

The Illinois property tax rate is

Effective property tax rate: 2.18%

Median home value: $256,300

Median real estate tax paid: $5,591

The Randolph County rate is 2.00 percent.

The three counties in Illinois with the highest effective property tax rates are Lake County (2.76 percent), DeKalb County (2.70 percent), and McHenry County (2.65 percent).

The Illinois counties with the lowest effective property tax rates are Hardin County (1.22 percent), Pulaski County (1.17 percent), and Pope County (0.98 percent).