SPRINGFIELD – The Illinois Fuel and Retail Association has issued the following statement

regarding the July 1, 2025 Motor Fuel Tax Inflation Adjustment

“Illinois drivers are already paying their fair share in motor fuel taxes and that amount is set to go up July 1st” said Nate Harris, CEO of the Illinois Fuel and Retail Association. “With the motor fuel tax rates tied to inflation, Illinois businesses and consumers are the main source of funding for building and fixing the State’s transportation infrastructure.”

“As Springfield nears the end of the 2025 Spring Session and budget talks ramp up, it is important for legislators to remember increasing the motor fuel tax not only impacts their constituents directly, through their increased cost at the pump, but also indirectly, through increased costs of goods and services throughout the economy”, said Harris.

With three weeks in the legislative session remaining, issues of expanded local and county motor fuel taxes, a low carbon fuel standard requiring a new carbon credit market, a mileage tax and regional transportation consolidation funding have all been concerns for the Illinois Fuel and Retail Association.

As of May 12th, 2025, the Illinois Road Fund has $3.61 Billion dollars sitting ready to be used for construction projects. Today, another $49.5 Million was added to the fund.

The Illinois Department of Revenue has released a series of informational bulletins outlining the updates to local, county and state motor fuel taxes taking place July 1st, 2025:

Municipal Motor Fuel Tax Rates – The Village of Bartlett (located in Cook, DuPage & Kane Counties) is imposing a 3¢ per gallon tax at retail effective July 1, 2025.

County Motor Fuel Tax Rates – County motor fuel tax rates are automatically increasing by 2.82% due to inflation, as determined by the Illinois Department of Revenue.

- DuPage–9.7¢ per gallon (0.3¢ increase)

- Kane–5¢ per gallon (0.1¢ increase)

- Lake–4.8¢ per gallon (0.1¢ increase)

- McHenry–8.5¢ per gallon (0.2¢ increase)

- Will–5¢ per gallon (0.1¢ increase)

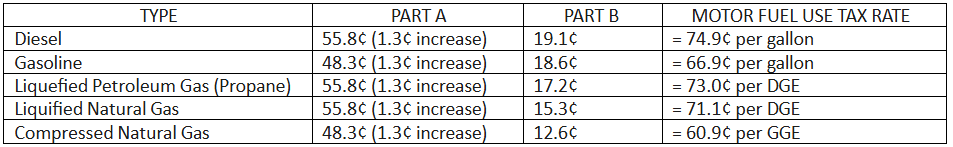

State Motor Fuel Tax Rates – Illinois’ Motor Fuel Tax is comprised of two parts. Part A is set in statute and adjusted annually for inflation. Part B is determined by IDOR by computing the average selling price per gallon during the previous 12 months and multiplying it by 6.25 percent to determine the rate.