PERRYVILLE — The Perry County School District 32 Board of Education on Wednesday approved a new adjusted property tax rate, a change that many residents might not even notice on their next tax bill.

The 2024-25 combined tax rate has been set at $3.4010 per $100 assessed valuation, a slight increase — a quarter of one-hundredth of one cent — from the previous $3.3985 per $100 of assessed valuation.

This includes an operating levy of $3.0631 per $100 assessed valuation and a temporary levy of $0.3354 per $100 of assessed valuation.

The school district announced the change in a news release, stating:

“What does this mean for district taxpayers?

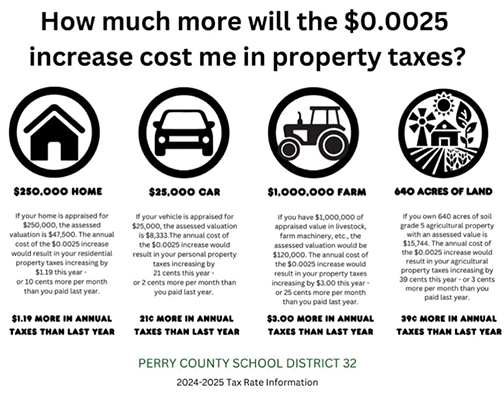

“If you live in a home appraised at $250,000, the assessed valuation is $47,500. The annual cost of the $0.0025 increase in your residential property taxes would result in $1.19 more this year than you paid last year, or about 10 cents more per month.”

The adjusted tax rate is divided into two funds, with $2.75 earmarked for the incidental fund and $0.6510 for the capital projects fund. The district currently has no teacher or debt service levies.

PCSD No. 32 Superintendence Dr. Fara Jones explained that the tax rate recommendation is based on a formula calculated with information such as the local tax ceiling determined by the Missouri State Auditor, and local assessed valuation of real estate and personal property. The Hancock Amendment can affect the calculation as well, but only in odd years when reassessment occurs.

“This rate allows the district to capture new construction plus the 1.15 percent increase in the assessed valuation,” Dr. Jones said. “This growth remains under the Consumer Price Index (CPI), which is currently 3.4 percent.

Both the operating levy and temporary levy remain below the maximum voter approved amounts and are at the current tax rate ceiling. The maximum operating levy approved by Perry County voters for the district is $3.2411 per $100 assessed valuation. The maximum voter-approved temporary levy is $0.35, which was approved in 2017 as Prop. KIDS to allow the new primary and middle school facilities; this is a 20-year tax that will end in 2036. This temporary levy is currently $0.3354.

The assessed valuation of real estate in the district increased to $283,367,354 for 2024-25, from $275,204,972 for 2023-24, a difference of $8.16 million.

The assessed valuation of personal property in the district increased to $125,027,606 from $120,094,432, which is $4.93 million more. The adjusted assessed valuation on which the district will receive tax revenue is $408,394,960.

If Perry County collects 100% of taxes owed, the district will receive $13,889,513 in local tax revenue, which is $455,263 more than in 2023-24, when it would have been $13,434,250 if all taxes had been collected.

However, in 2023-24, the county collected 95 percent of taxes, so the District received $12,732,721 in local revenue — $701,529 less than expected. The district later collected $393,986 in delinquent taxes from prior years.

Just over $290,000 of this expected $455,263 increase in local revenue for the District is due to new construction and improvements, while $164,560 is new revenue based on reassessments.